What national treasure Shark Tank has become, no? Whether you watch it because you like to see what is the up and coming new products from entrepreneurs or because you enjoy seeing the ultra-rich hosts argue about how many hundreds of thousands of dollars they’re willing to invest into the company; all that matters is that this show features some of the coolest ideas that humans have right now. Go ahead, check these out, you’ll be surprised to see a few inventions that you use daily that you didn’t know cam from Shark Tank.

50. X Craft

X.craft appeared in season seven of Shark Tank. XCraft produces innovative drone technology, and CEO JD Claridge and co-founder Charles Manning appeared on the show to pitch the company. They entered the tank with their main product the X PlusOne flying ahead of them. The pair requested $500K funding in exchange for 20% equity. After their pitch, a fierce and bloody shark fight ensued, with each shark wanting a piece of the action. In the end, every single shark invested a total of $1.5 million in the business in exchange for 25% equity. Now, the company is worth around $5 million, with this value projected to rise in the future.

49. Tree T-Pee

Tree T-pee is a cheap alternative to watering crops and was developed for farmers. The technology conserves water effectively, and in 2016, Johnny Georges pitched his technology on Shark Tank. He wanted $150K for 20% of the company. In an emotional pitch, John reveals that he doesn’t care about the profit, although that would be a nice bonus, he wanted to help farmers. John Paul DeJoria is a guest shark in this episode, and he offers Johnny precisely what he came for: $150K in exchange for 20% of the company.

48. Beer Blizzard

Beer Blizard is a reusable plastic ice cube that keeps beer cold for long and solves the problem of warm beer. Tom Osbourne and Mike Robb appeared on the show in 2016, hoping to receive a $100K investment in return for 20% of the company. Aside from funding, they also needed a shark to open the doors to retail stores across the country. Although the sharks agreed the product wouldn’t make millions, Mark felt there was potential for relative success. He offered $100K for a 20% stake in the company. The pair accepted the offer. In the days following their appearance, the company saw a 5000% increase in sales. Today, they have achieved their goal of reaching retail chains across the country.

47. Guardian Bikes

In 2017, Riley and Kyle Jansen presented their pitch to the sharks. Guardian Bikes is a technology that reduces the risk of the bike flipping over in case of a sudden stop. The pair requested $500K for 10% equity of the company. The sharks felt the company should have stuck to licensing the technology, not manufacturing bikes. However, Mark saw potential in the company and made an offer of $500K for 15% equity.

46. Ten Thirty Productions

Ten Thirty Productions is a live-action horror entertainment company which made one of the biggest deals ever on the show. Melissa Carbone is the owner of the company and walked into the tank asking for $2 million investment in return for 10% of the company. Her entrance was spooky and impressive, with a ghoul woman trailing her entry. Mark bit the pitch and offered her the amount she wanted, albeit in return for a 20% stake. Since then, business has been excellent. The company recently made $2 million in revenue and is projected to make even more this year.

45. Red Dress Boutique

Red Dress Boutique appeared on season six of the show and was pitched to the sharks by Josh and Dian Harbour. The Harbours sought $600K for 5% share of their company. In their fourth year before appearing on the show, the company made $7.5 million in sales. The sharks found this very impressive. Robert and Mark bit on the pitch, offering $1.2 million; however, in the end, only Mark made a deal with the couple. In 2018, the company generated $15 million in sales.

44. Rags to Raches

Rags to Raches is the brainchild of Rachel Nilsson. The clothing line makes handmade clothes for kids, and the bestselling item is the romper. When she appeared on season seven of the show to pitch her product, a fierce shark fight occurred. She got offers from Robert, Kevin, and Daymond. She ultimately decided to go with Roberts’s offer of $200K in exchange for 15% equity stake of the company. Today, the company has generated over $1 million in sales and has appeared in popular magazines like Vogue and Forbes.

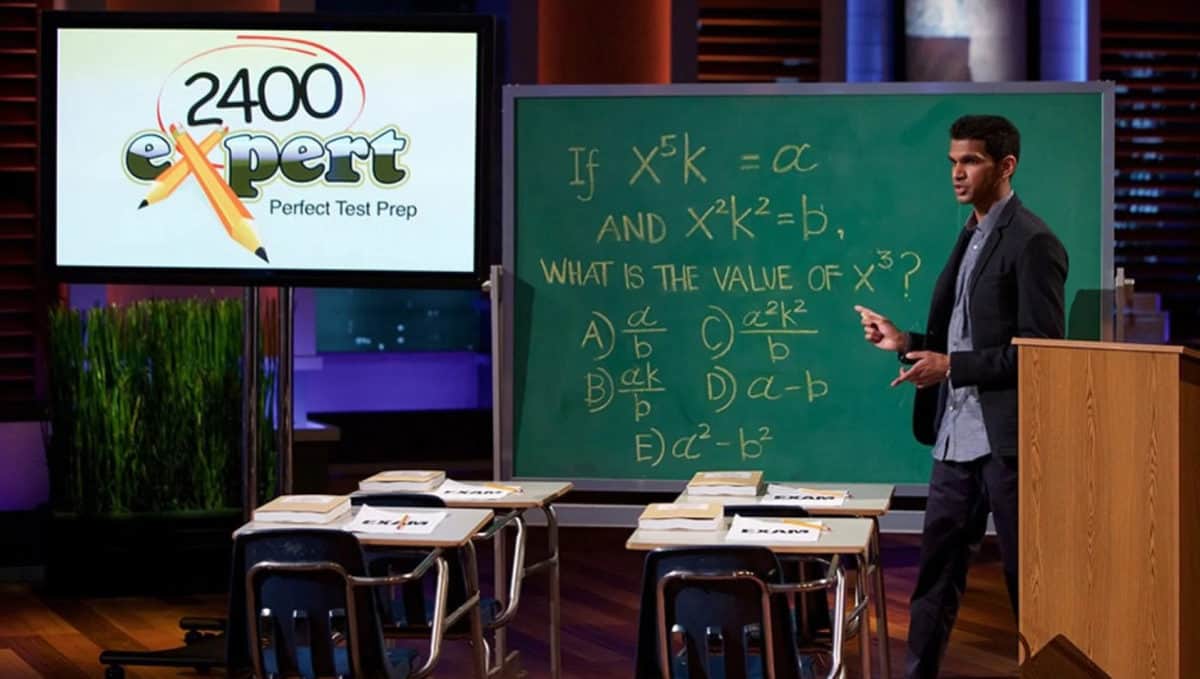

43. Prep Expert

Shaan Patel appeared on Shark Tank in 2016 to pitch is start-up Prep Expert SAT & ACT Preparation. The test-prep startup was created to help people taking SAT and related exams. He sought $250K for a 10% equity stake in the startup, which was roundly denied by the sharks. Although they saw the merit in the start-up, the sharks felt he couldn’t juggle being a doctor and an entrepreneur. However, Mark thought he could still make something of the startup, and they made a deal. Today, the startup has helped thousands improve their scores, and Shaan has evolved to become an author.

42. Mai Lieu

When Mai Lieu was four years old, she and her family were able to escape the Vietnam War. Now, an author, entrepreneur, and speaker, she appeared on Shark Tank to pitch her beauty tools to the panel. Her main product, CreaClip, is a plastic tool made for people to cut their hair themselves. She sought $200K in return for a 10% stake in CreaProducts. After her pitch, and cutting her hair on-stage, Robert and Mark were the first sharks to go out, followed by Kevin. In the end, Lori offered her $200K in exchange for 22.5% of the company. The business has so far been successful, with sales volume rising 5000% after her appearance on the show.

41. Lumio

When Lumio appeared in season six of the show, it was met with approval by the sharks. The product, created by Max Gunawan, is a lamp that looks like a notebook when closed. Before pitching his idea on Shark Tank, he had made $1 million in sales. What he wanted was a $250K investment in return for 8% equity stake. All the sharks made offers, but he was swayed by Robert’s $350K for a 10% equity offer. Since then, it has become one of Shark Tank’s most successful products, selling at high-end retail stores around the globe.

40. Lovepop

Lovepop creators, Wombi Rose, and John Wise use design software and laser cutters to create 3-D greeting cards. The pair sought funding on Shark Tank in 2015. Walking into the tank, they pitched their idea and asked $300,000 for a 10% equity stake. According to them, aside from the money, they wanted a shark that would open doors to other opportunities and help them grow the business. Kevin was completely sold on the product, and he offered the pair $300K for 10% equity, just what they wanted! The investment has paid off, and Lovepop currently has a net worth of $21.2 million.

39. Lollacup

Lollacup is a children’s drinking cup with zero BPA and phthalate. The product features a flexible straw that makes drinking easier to do, especially for toddlers. Created by a couple, Mark and Hanna Lim, the cup was initially for their nine-month-old daughter. The couple saw a business opportunity and came to Shark Tank requesting for $100K in return for 15% of the company. Mark Cuban and Robert Herjavec were the sharks that bit, offering the couple $100,000 for 40% equity. The product has made giant strides since coming on the show. It can be found in over 650 stores and has made over $2 million in sales.

38. Kisstixx

A flavored lip balm that changes the kissing experience, Kisstixx allows customers to mix and customize the kissing experience. The creators Dallas Robinson and Mike Buonomo came to Shark Tank seeking $200K for 20% equity stake. Mark, Daymond, and Robert made different offers for the product. However, the pair refused the offers from Daymond and Robert, accepting Marks $200K for a 40% offer. The product has enjoyed success after its appearance on the show. It is sold at different retailers and is available on online retail stores like Amazon and Drugstore.

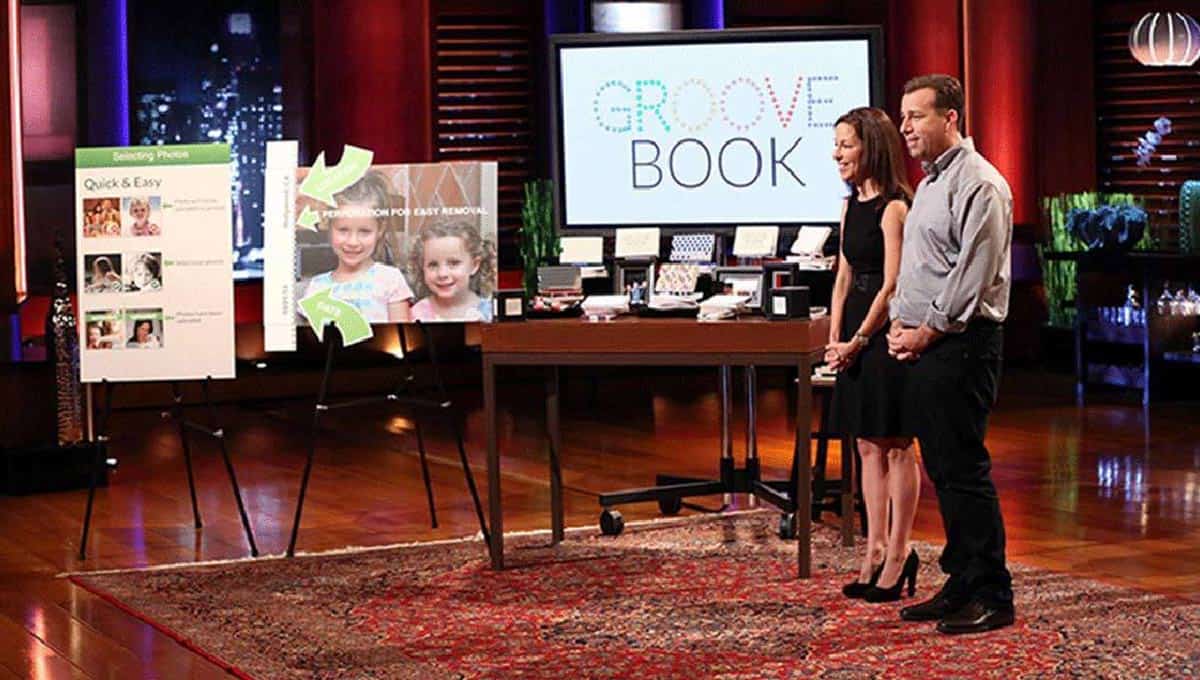

37. Groove Book

Groove Book is an application that allows users to bookmark social media photos and get physical copies in a customized photo book. While print appears to be going the way of the dodo, owners Julie and Brian Whiteman have tapped into print-on-demand. They appeared in season five of the show and wanted $150K for 20% equity stake. In the end, they agreed to a $150K investment in exchange for 20% of licensing revenue offered by Mark and Kevin. In 2015, they sold the company to Shutterfly for $14.5 million.

36. Emazing Lights

Brian Lim walked into the tank requesting $650K for 5% of the company, but in his words “it is not about the money, but the value the investor would bring to the company”. He came in wearing a giant carton headpiece, but when the carton comes off and he demonstrates his product, the sharks see that he is the real deal. The product, which is, in simplest terms, creating

a light show with your hands thoroughly impressed the sharks. At the end of the episode, he makes a deal with Mark and Daymond who offer $650K for 5% equity and 20% commission on licensing Daymond gets for the company. The brand has grown and in 2018, made sales of around $30 million.

35. Dollop Gourmet

Dollop Gourmet is the brainchild of Heather Saffer. Dollop Gourmet is an all-natural, zero-preservative, vegan brand that specializes in frosting. In 2016, Heather came on Shark Tank to secure funding for her brand. She sought $75K and in return would give up 20% equity in her company. In the end, she won over Barbara who offered $75,000 in exchange for 25% equity in the company. After the show, it was revealed that negotiations broke down and she walked away with nothing.

34. Cycloramic

Cycloramic uses your smartphone’s technology to take hand-free panoramic pictures. Cycloramic, prior to appearing on the show had enjoy moderate success. However, Bruno Francois, inventor of the app decided to pitch his product on Shark Tank in order to get a marketing boost. After just some minutes into his pitch, he had received an offer higher than the $90K he wanted. It was clear this product was a “hero”. In the end, after a frenzied bidding process, Bruno struck a deal with Lori and Mark who offered him $500K for 16 ½ % of the company. In October 2017, Francois sold the company for $22 million.

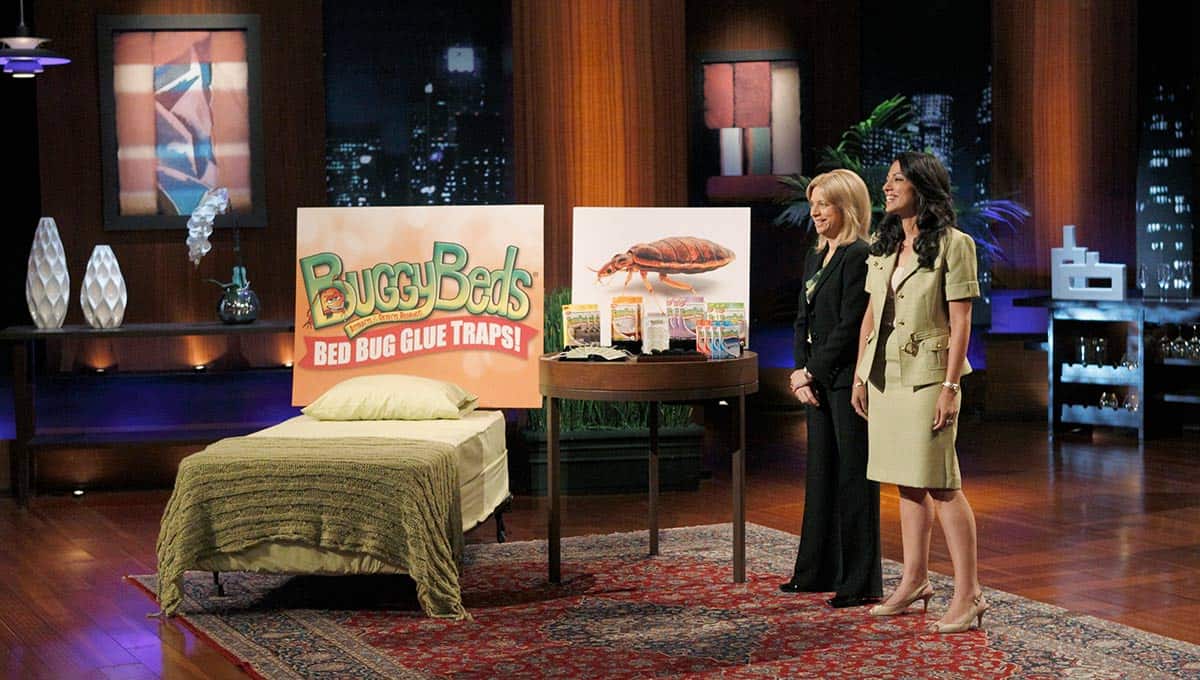

33. Buggy Beds

Buggy Beds detects bed bugs quickly. Since bedbug infestation is an epidemic, the product allows you to take preventive measures before a full infestation occurs. Created by Veronica Perlongo and Maria Curcio, the pair walked into the tank asking for $125,000 in exchange for 7% stake in the company. After the pitch, an unusual thing happened. All the sharks want a piece of the action! In the end all sharks make a joint offer of $250K for 25% shared equity. Today, the product has proved a roaring success. It is one of the most successful products in Shark Tank history.

32. Bottle Breacher

The Bottle Breacher is an interesting product that was co-founded by a Navy SEAL, Eli Crane. He operates the company with his wife Jen Crane. The product is a bottle opener, but with a twist. These bottle openers are handcrafted, .50 caliber bullets. The product appeared on Shark Tank in 2014. Kevin and Mark were very interested in the product and jointly invested $150K in exchange for 20% equity stake. After its appearance on the show, popularity and demand soared. Sales have rocketed from around $150K to up to $15 million!

31. BedJet

Mark Aramli, a former employee at NASA, appeared on the show in 2015. He came pitching the BedJet, a mattress pad that allows users to adjust it to their desired temperature. To say he wasn’t well received would be an understatement. No single shark made an offer, and Lori later said that she was angry at his behavior. Furthermore, they felt his $2.5 million valuation was too unrealistic. Aramli walked away empty-handed, but in hindsight, he likely doesn’t mind. His product made around $3million in sales months after his appearance on the show.

30. Beat Box

Justin Fenchel , Aimy Seadman, and Brad Schultz walked into Shark Tank seeking $200K for 10% equity stake in the company. They ended up walking out with $1 million for a 33% equity stake! Beat Box beverages is packaged as a fun alternative to traditional wine and boxed wine. Mark realized the brand wasn’t selling wine, but were selling a fun experience. As a result he invested a whooping five times the amount requested. Today, the brand is doing quite well and is found in over 750 stores across 18 states.

29. Ring

Jamie Siminoff appeared on Shark Tank in 2013, pitching his idea for “DoorBot”, which has since been renamed Ring. The technology allows homeowners to see who is at the door right from their smartphones. Although the idea seemed great, none of the sharks was willing to meet $700K and 10% equity stake Jamie wanted. He walked away without striking a deal. Letting him walk away is regarded as one of the worst mistakes made by the sharks on the show. Ring was acquired for over $1billion by Amazon in 2018!

28. Kodiak Cakes

Kodiak Cakes is a flapjack and waffle mix made with100% whole grains and zero sugar or fats. Cameron Smith and Joel Clark came on Shark Tank to pitch the product. They requested for $500K and in return, the shark that bites gets 10% of the company. After some tough negotiating, the best offer the pair got was $500K in return for 50% of the company. Cameron and Joel refused and walked away without striking a deal. Fortunately for them, their decision has proved smart. Now, Kodiak Cakes is one of the most popular and successful pancake and syrup brands. They have several deals with large companies and can be found in various stores across the country.

27. Bantam Bagels

Nick Olesack and his wife Elyse came to Shark Tank requesting for $250K in return for 11% equity share in their company. The pair had found a niche: people wanted delicious bagels that were not doughy and calorie dense. The couple needed the funding to expand the business by building a commercial kitchen. Robert and Mark were the first to step down because they felt investing was too risky. While the other sharks haggled, Lori swooped in and offered the couple $250K at 25% equity. The deal was sealed! Bantam Bangles has been a huge success. They have struck deals with Starbucks, Delta airlines and it seems the sky is the limit for these delicious bagels.

26. The Hoodie Pillow

Chris and Rebecca appeared on the show in 2013 and sought for a $90K investment in exchange for 15% equity share in the company. Rebecca had appeared on the show in 2011 and she acquired funding from Kevin Harrington. This time she came with Chris to pitch the Hoodie Pillow. The item functions as a hoodie, but offers convenience when lying down and other features. While the product drew appreciative noises from the sharks, the offers they made didn’t suit the pair. Things seemed to be heading for the rocks until Robert agreed to invest $90K for 20% of the company. Following its appearance on the show, sales have dramatically increased.

25. Grace & Lace

Grace & Lace appeared on the show in 2013. Owned by Rick and Melissa Hinnant, the company company makes faux socks that add flair to a woman’s boots. The couple seeks a $175K investment in return for 10% equity stake in the company. After revealing that they had made over $1.2 million is sales prior to coming on the show, everyone sits up. Lori is the first to opt out, citing that although the product is impressive, she doesn’t feel any connection to it. Although Robert and Mark offer exactly what the couple wants, they later pull out because they feel the couple is indecisive. In the end, they strike a deal with Barbara who offers $175K for 10% equity. Within days of appearing on the show, their sales exceeded the $1 million mark and as of today, they have made over $20 million in sales.

24. The Beard King

Nicolas and Alessia Galekovic are one of the most interesting pairs to come on Shark Tank. Self-acclaimed king and queen of Beard kingdom, the pair requested $100K funding in return for 20% equity stake in their company. The company made a beard bib that allows grooming to be done cleanly, without leaving a mess. Although the product seemed great, most of the sharks pulled out without even making an offer. Lori decided to invest, though, offering $100K for 45% equity. Since there were no other offers on the table, the pair agreed. However, after the show, the deal fell through during negotiations. However, as at 2016, the product was on track to make $1.6 million in sales.

23. Tower Paddle Boards

There are many success stories on Shark Tank and Tower Paddle Boards is one of the most successful products from the show. Stephen Aarstol, the brain behind Tower Paddle Boards walked into the Tank requesting for $150K for 10% equity stake. His presentation is off to a great start, but during the slideshow he runs into technical difficulties. His pitch went so badly Barbara called him the worst presenter she had ever seen on the show. Mark Cuban , however saw something else and invested $150K for a 30% equity stake. Today, Tower Paddle Boards has made more than $25 million in sales, making it one of the most successful products to come through the hit reality show.

22. ChordBuddy

ChordBuddy is one of the most original and successful products to ever feature on Shark Tank. The product is designed to help beginners learn the guitar while playing on a guitar. It is a real-life Guitar Hero. The product attracted Robert Herjavec and he offered $175K for a 20% equity stake in the company. A year after appearing on the show, ChordBuddy went on to make over $2 million in sales, and has steadily become more common and more successful.

21. FiberFix

FiberFix is a solution to leaks and breakages that cannot be handled by duct tape. Although duct tape is great, according to Spencer Quinn and Eric Child, FiberFix is better. The pair walk into the tank looking for $90K for 10% equity in their company. They demonstrate to the panel how much better their product is than duct tape. The demonstration impresses the judges and they get down to business. All the sharks are interested in striking a deal, but due to one reason or the other, only Lori remains. She offers them $120K for 12% which the pair agree to. Today, the product has grown exponentially, can be found in almost every store and has made over $50 million in sales.

20. Unshrinkit Solution

Cloth shrinkage is an annoying problem millions of people face. Nate Barbera and Dez Stoler came up with Unshrinkit Solution, which is a chemical solution to the problem. By applying the product to shrunk cloth, the original shape and size can be restored. Although Lori pulls out early, the other sharks are interested. Daymond offers $150K for 25%, Kevin offers $150k for 33%, while Mark offers the pair $150K for 15%. They immediately accept Mark’s offer and their excitement is palpable. The product has been doing relatively well so far.

19. Screenmend

Founded by the Hooks family, Screenmend is an easy to use kit that makes repairing window screen or door screens very easy. The family entered the Tank looking for $30K in exchange for 25% equity stake in the company. Daymond was the first shark to opt out because he believed the family’s business inexperience was too much of a hurdle. Kevin and Robert also pulled out for the same reason. Mark offered the family $30K at 25% equity while Lori countered with $30K for 50% equity. However, she offered to put in more work in making the business succeed. This won the family over and they struck a deal with Lori. The company has made over $3million in sales which is a vast improvement over the initial sales made prior to coming on the show.

18. Cousins Maine Lobster

Cousins Sabin Lomac and Jim Tselikis began the Cousins Maine Lobster in 2012. They were invited on to Shark Tank by the producers. The cousins brought their authentic Maine lobster roll experience to the Tank. The company caught the attention of Barbara Corcoran who invested $55K in the business. This investment paid off magnificently and as of today, Cousins Maine Lobster has generated well over $20million in sales. The company has a website that customers can order live Maine lobsters from.

17. Simple Sugars

Lani Lazzari appeared on season four of Shark Tank with her company Simple Sugars. The company makes natural skin-care products that assist with a variety of skin problems. She came into the tank offering 10% equity stake in the company for $100K. Although impressed with Lani’s drive, Lori, Robert, and Kevin backed out of investing. They cited inexperience, fierce competition, and the lack of propriety. Mark, to everyone’s surprise, was the shark that bit. He offered a steep price, though; $100K for 33% equity stake. Lani wasn’t too pleased about this and tried to beat it to 25%, but Mark stood his ground. In the end, Lani agreed to the deal. As of today, this company has made over $3million in sales.

16. FunBites Food Cutter

Getting kids to eat healthy food can be challenging. Bobbie Rhoads faced this challenge with her kids and ended up inventing the Fun Bites food cutter. The device allows you to cut up your food into fun shapes and makes eating more enjoyable. She came to Shark Tank looking for $75K in exchange for a 20% equity stake in the company. The cutter caught the attention of the sharks with Daymond and Lori offering to invest in the company. Lori finally won the heart of Bobbie, offering her the exact amount and equity Bobbie wanted. After the show, the company made $150K in sales and with Lori’s aid has now expanded worldwide.

15. Sleep Styler

Tara entered the Tank rocking what seemed like large curler in her hair. After introductions, she asked the Sharks for $75K for 20% equity. The Sleep Styler dries and styles your hair while you sleep, saving much time spent on getting ready for work in the morning. She then stated that aside from the money, what she really wanted was the expertise of the sharks. Lori was impressed with the product and the sales generated and offered $75K for 30% equity. Tara countered the offer by asking for the same amount but for 25% equity. Lori agreed to the deal and the two women happily struck a deal. The product has seen an incredible upturn in sales, from $47K to up to $100 million in two years!

14. Signal Vault RIFD Blocking Credit/Debit Card Protector

Signal Vault is touted as the solution to identity theft. Identity thieves use Radio Frequency Identification scanners to steal information, and Signal Vault serves as a shield. Chris Gilpin, inventor of the technology came to Shark Tank asking for $200K for 12 ½ % equity stake in the company. Ashton Kutcher was a guest shark in the episode and was visibly enthusiastic about the product. However, after Gilpin’s pitch, he opted out because he believed the company’s competitor was too strong and established to displace. Lori offered $200K for 18% equity while Kevin offered to invest for 20% equity stake. Although he offered the same $200K as Lori, he cited his expertise in the financial securities sector as invaluable. Robert also offered $200K for similar equity. Mark opted out of investing, believing that the product should be targeted at consumers and not business or corporate bodies. In the end, negotiations concluded at 25% equity for $200K. Chris got the money he wanted, the expertise of Robert and Lori, all for 25% of his company. Today, the company has steadily expanded, taking in more employees and renting new offices.

13. Breathometer

This product appeared in season five of the show. It was founded by Charles Yim and provides a way for users to check their blood alcohol content by using their smartphone. Charles came asking for $250K for a 10% stake in his company. Immediately after his pitch, there is an unusual flurry of bidding from every single shark in the tank. Mark Cuban enthusiastically wants to invest $500K for 20% equity. Lori asks to partner with Mark and wants to handle the QVC end. Kevin also wades in and offers $250K for 15%. Robert offers $250K as well. Mark refuses to partner with other sharks, leaving Lori to offer $250K as well. Daymond also offers $250K for 10% equity. Kevin, Lori, and Robert agree to work together, offering a total of $750K and 10% equity each. In the end, Mark and Daymond agree to work with the other sharks, with Mark offering $500K for 15%, and the other sharks offering the remaining $500K and 15% equity. Charles readily agrees to the $1million investment and sells 30% equity to the sharks.

12. Drop Stop

Drop Stop is the brainchild of two good friends, Marc Newburger and Jeffrey Simon. The device serves to stop objects from falling in the space between the car seat and handbrake. The pair walked in the tank cheerfully and asked for $300K for 15% equity stake in the company. After revealing that they have sold more than 260,000 units of the products, all but Kevin seemed very impressed. However, Robert doesn’t believe there is a market for it and Daymond doesn’t find the product worth believing in. Mark also backed out citing that he doesn’t think he can add any value. Kevin, who at first seemed disinterested, and Lori battle it out. Kevin offered $300K and $1 royalty on every unit sold. Lori offered the same amount but wanted 20% equity. The pair decided to go with Lori. Today, the Drop Stop is the bestselling accessory on Amazon and continues to make impressive sales.

11. Copa di Vino

Copa di Vino literally means “a glass of wine”. It was invented by James Martin from Oregon. James hails from a family of farmers and with Copa di Vino; he hopes to make wine easier and more accessible for folks to enjoy. James walked confidently into the Tank and requested for $600K investment, in return for a 20% equity stake. After his pitch Daymond John, Barbara, and Mark opt out with only Kevin making an offer. Kevin offers $600K for 51% equity stake. Martin flat-out refuses, saying he has invested too much in the company to hand over a majority share to someone else for that amount. He counters Kevin’s offer by asking for $3 million in exchange for 51% equity stake. Kevin angrily refuses and Martin fails to find an investor. However, he has made over $5 million in sales so far.

10. Zipz

Henry J. Scott is the brain behind Zipz. He partnered with an expert in the wine industry, Andrew McMurray to package wine in single servings. Andrew revealed that the company had already received significant amount of funding from other investors. However, sales were poor and he needed the expertise of the sharks. Mark and Daymond opted out of investing. Mark had issues with the branding, and Daymond believed the risk was too high. Kevin finally agreed to invest $2.5 million for 10% equity stake and an option to buy another 5% when exiting.

9. Wicked Good Cupcakes

Tracy and Danielle are a Boston-based mother and daughter team behind Wicked Good Cupcakes. The pair walked in asking for $75K for 20% stake in the business. Although the business model seemed great, the sharks were concern about the shelf-life of the products. Robert and Daymon didn’t think it smart to invest in the cupcake space, while Mark felt it could be a great business, but didn’t fit his business ideas. In the end, Kevin, surprisingly, bit and offered the pair $75K and 45 cents on every jar sold. The business is doing well today and has recently opened a new branch in Boston, hiring up to 40 employees.

8. Tipsy Elves

Tipsy Elves was pitched as an ecommerce apparel company that specialized in making some really ugly Christmas sweaters and clothing. Made by Evan Mendelson and Nick Morton, the pair came looking for $100K for a 5% equity stake in the company. After their pitch, Mark was the first shark to opt out. He was not sure that the founders can focus on a core competency. Lori backed out next, saying that there was nothing that set the clothing line apart from the others. Kevin bit, though, and offered $100K and $1 royalty on each unit sold: no equity stake. Robert then spoke up, offering the pair $100K for 10% equity stake. They agreed and a deal was struck. As of 2018, the clothing line has sold $70 million worth of clothes and is one of the most successful shark tank businesses.

7. Bubba’s Q Boneless Ribs

Ohio native, Al “Bubba” Baker came to Shark Tank seeking an investment of $300K for 15% equity stake in his company. His product was special: ribs without the mess that comes with eating them. All the sharks are interested in the product. However, after citing different reasons, all but Kevin and Daymond pull out. In the end, after some tough negotiating only Daymond remained as an investor. He offers $300K and 30% equity stake of the company which Baker agreed to. As at 2018, Bubba’s Q Boneless Ribs can be found in various stores in and around Ohio. Sales have also improved from a paltry hundreds of thousands to more than $3 million.

6. ReadeRest Original

Shark Tank has proven time and time again that the most simple of products can bring in millions of dollars. This magnetic holder was introduced by Rick Hopper and pitched to the sharks. Rick came in stumbling, literally. He fell on the edge of the carpet just as he was entering the tank. He wasn’t fazed, though, and he asked for $150K for a 15% equity stake in his company. Everyone pulled out except the “Queen of QVC” Lori Greiner. She saw the future of the magnetic glasses holder and offered him $150K, but at 65% equity. Rick grudgingly agreed. Today, the company has made sales of over $8million in two years. Rick must be happy!

5. Bombas

Bombas cofounders David Heath and Randy Goldberg appeared on Shark Tank in 2014. They struck a deal with shark Daymond John, but it wasn’t easy getting it. The men came intending to secure $200K in exchange for a 5% equity stake. Mark Cuban and Lori Greiner opted out, with Mark saying the company couldn’t grow any further. Robert didn’t fancy the customer acquisition model of the company and opted out as well. Daymond bit, however, and offered the pair $200K for a 20% equity stake. They finally agreed on the said amount but with a 17.5% equity stake. In 2017, Bombas recorded almost $50 million in revenue.

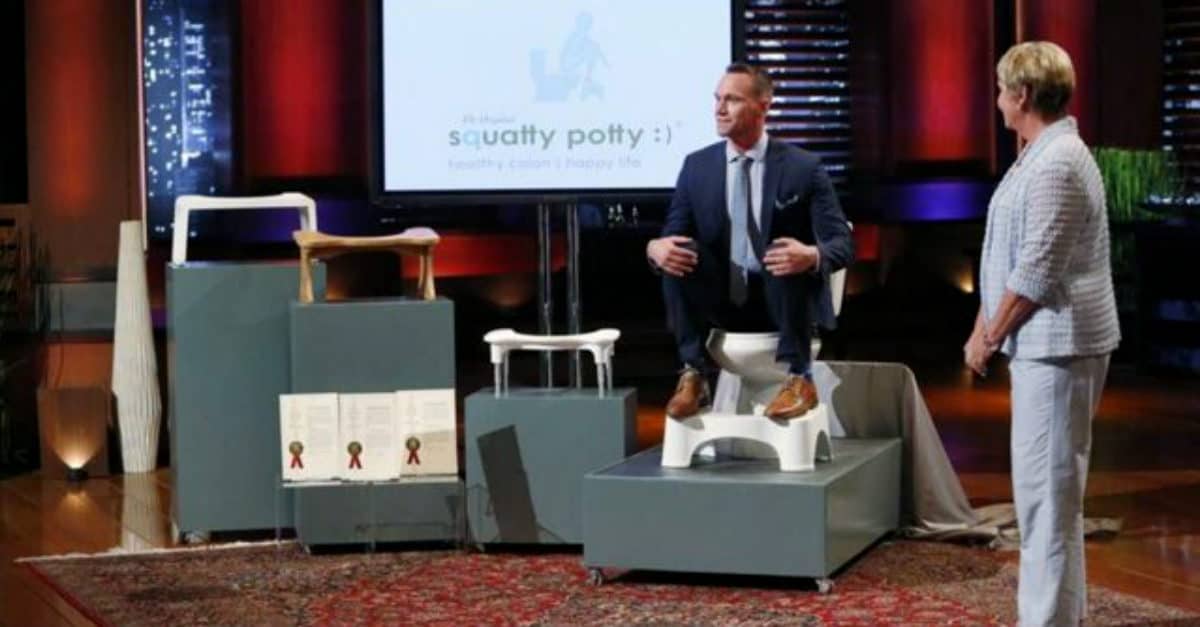

4. Squatty Potty

The Squatty Potty is one of the most memorable and distinct products that ever featured on Shark Tank. Invented by the Edwards family, the Squatty Potty took the panel by storm. The simplistic design made so much sense and is made to “change the way we poop.” Bobby Edwards explained how the body eliminates wastes. He then explained that squatting while pooping makes bowel movement easier and more comfortable. It also had the benefit of reducing the risk of hemorrhoids. “QVC Queen” Lori Greiner bit this product and invested $350K for a 10% equity stake. Since then, the product has done over $30 million in total sales and shows no signs of slowing down.

3. The Beebo

In the first episode of season 7, Beebo inventor, Martin Hill stepped into the Tank. He came seeking for $200K for a 20% equity stake in his company. His product? A silicone fitting over a person’s chest that allows you to feed your baby with one hand, leaving the other hand free to engage in other activities. How did the judges react? Ashton Kutcher was the guest shark on the episode, and although he liked the product, he opted out. Mark also opted out, leaving Lori and Kevin to battle it out. Lori encourages Ashton to partner up with her, as he would be great for his social marketing connections. In the end, the pair convince Martin to accept their $200K at 15% equity offer. Today, the Beebo is doing quite well and can be found on Amazon and retailers like Babies ‘R Us.

2. Simply Fit Board

The Simply Fit Board was designed by a mother (Linda Clark) and daughter (Gloria Hoffman) duo and pitched to the Shark Tank panel in November 2015. The pair went in the show with the hopes of securing a $125K at 15% equity investment from the sharks. While other sharks pulled out, Lori and Kevin fought for the opportunity to invest in the product. After a tough period of negotiations, Linda asked if Kevin and Lori would consider doing a deal together. Lori flat out refused, citing her successful record with QVC. In the end, they made of deal with Lori; $125K for 20% equity. Today, the product has done more than $160 million in sales and is available in stores across the US and is even found in parts of Europe, Asia, and Australia.

1. The ScrubDaddy

Aaron Krause, an inventor from Philadelphia, came with a simple product that at face value, seemed to be, in the famous words of Lori Greiner “a zero.” The product? A scrubbing foam that he claimed made cleaning easier. Although the panel initially looked unimpressed, after he demonstrated the benefits and features of the product, and revealing sales of over $100,000 in just four months, a bidding war ensued. He eventually stuck with Lori, who offered him $200K for a 25% stake in the company. Scrub Daddy went on to make over $50 million in sales within three years of coming on the show, and it is arguably the most successful shark tank product till date.